Acclaim9638

Beginner

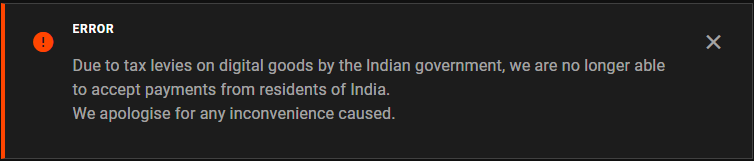

I was trying to purchase a premium subscription to Nexus Mods when I saw this.

So I tried to find more details, and this is what they had posted in their forums:

Does anyone know what this tax is?

So I tried to find more details, and this is what they had posted in their forums:

I'm afraid that is correct. We have blocked payments from India for the foreseeable future.

We were contacted by your government's tax services recently telling us they have introduced a (relatively) new worldwide tax system on all digital services sold to Indian residents, even from businesses outside the country. The tax process is extremely long winded and stifling to a small business such as ours and, oddly, has absolutely no minimum earning threshold. A lot of other VAT-based tax systems have a "minimum amount" before it applies, for example, the EU's VAT MOSS tax system, which has similar principles to the Indian tax system has a minimum threshold of 10,000 euros a year, which we would be well under in India if India had such a threshold to help protect small businesses. Unfortunately, India does not have a minimum threshold and we are legally culpable to pay tax in India if a single Indian resident buy's Premium Membership on our site.

The amount we earn from Indian residents would never outweigh the cost of paying for an Indian accountant to process the tax forms and payments for us each month, nor would it be worth our time to do the work manually, so we've sadly had to block payments from India so we do not get sued by your government's tax services for breaking their rules.

It's a sorry state of affairs, and I only hope more countries don't implement these extremely complex tax systems without more protections and support for SMEs.

Does anyone know what this tax is?