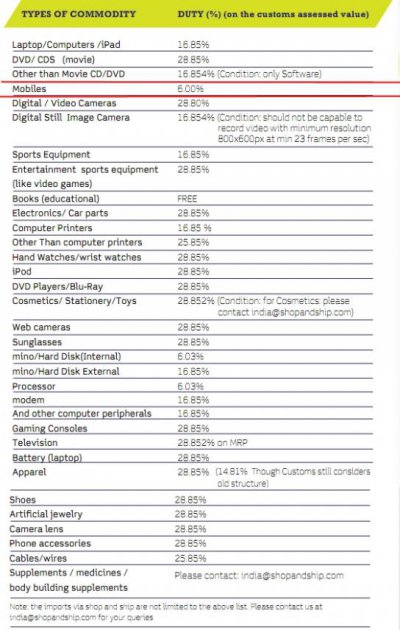

The basic customs Duty (BCD) on mobile phones was nil and remains Nil. The Excise duty which was earlier 1% is now hiked to 6%. When we import the phones the excise duty is collected as countervailing Duty (CVD). There is an additional duty known as Additional CVD whichs was and remains at 1%. So the total duty will be 6+1 = 7% now. On this duty you pay 3% as Education cess. The change in duty is effective immediately. I welcome to be corrected by persons having more authentic information.

Prices set to raise on imported handsets

- Thread starter chetansha

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

They have Increased thrice the Amount

Previously it was 2% and now its 6%

WTF is this Cheat Corrupt Govt Up to...

Will live in a Country Where no Can ? the Govt...

Kuch Nahin ho sakta is India Ka...

Chors and Scams from Top to Bottom :|

They didn't increase thrice the amount, it is being jacked up by 200%, which means increased by twice the previous amount.

I forgot to mention. Direct taxes are effective from 1 April whereas indirect taxes are effective immediately after the budget. Additionally the budget says "Duty on mobile phones increased to 6%" I am not sure whether it means excise or customs duty

@bigbyte you are right bro.

@bigbyte you are right bro.

Last edited by a moderator:

varkey

Galvanizer

Additional customs duty :- equal to central excise duty leviable on like goods produced or manufactured in India. Additional duty is commonly referred to as Countervailing duty or C.V.D. It is payable only if the imported article is such as, if produced in India, its process of production would amount to 'manufacture' as per the definition in Central Excise Act,1944. Exemption from excise duty has the effect of exempting additional duty of customs.

Business Portal of India : Doing Business Abroad : Taxation : Customs Duty (Export and Import Duty)

CVD = Excise Duty so when the excise duty is increased, the total duty is automatically increased.

veer_singh

Contributor

We are on the Same BoatI was charged 2936.77rs on Iphone4S 32gb , Crap, No more FUN , bastards !

I cried and slept

End of Era,no More Imports of Phones

f$uck Govt....I hate These Buggers

chetansha

Juggernaut

@veer_singh , what was you purchase price / inv value, did you get it thru sns or ppobox?

Please mention so it might help other buyers

Please mention so it might help other buyers

Last edited by a moderator:

veer_singh

Contributor

veer_singh , what was you purchase price / inv value, did you get it thru sns or ppobox?

Please mention so it might help other buyers

SNS , invoice was 320$ .

P.S . Invoice value does not matter !!!

veer_singh

Contributor

So what would be the duty on 2 Nexus 4 valued at $760?

Probably around 2-4k

Can you post the Bill of Entry?

I will do that on tuesday afternoon !

priyasukumaram

Discoverer

It's pathetic to see people blame the government for taking such steps. What do you want next - India to be ruled by the British? Oh, wait, that already took place.

There are other topics you can blame the government for, but not this. It's a financial measure to protect domestic interests.

There are other topics you can blame the government for, but not this. It's a financial measure to protect domestic interests.

veer_singh

Contributor

It's pathetic to see people blame the government for taking such steps. What do you want next - India to be ruled by the British? Oh, wait, that already took place.

There are other topics you can blame the government for, but not this. It's a financial measure to protect domestic interests.

British ?

Increasing tax doesn't improve country my friend , many countries in gulf , singapore are tax free .

India lacks in punishment , crime control , illegal stuff are slipping so easily .

No one said here that they don't wanna pay tax .

raksrules

Oracle

Ok then explain why Govt increased tax or duty or whatever it is on set top box when it is forcing digitization of the cable in entire country ? It is simple. They want to milk each and every source of income. Increase duties and such on each and everything which is either in demand or is imposed as compulsory. Why only mobiles duty increased ? They see what is lower and what is being imported in large quantities and in order to milk that, increase duties. Shocked to see some people defending this corrupt government.It's pathetic to see people blame the government for taking such steps. What do you want next - India to be ruled by the British? Oh, wait, that already took place. There are other topics you can blame the government for, but not this. It's a financial measure to protect domestic interests.

chetansha

Juggernaut

So what would be the duty on 2 Nexus 4 valued at $760?

Approx 760*55*7% = 2950± surcharges , service tax. Etc

veer_singh

Contributor

Approx 760*55*7% = 2950± surcharges , service tax. Etc

Only if they consider invoice value or it will be more or less .

chetansha

Juggernaut

Only if they consider invoice value or it will be more or less .

If you use ppobox, then invoice value , if you use sns, then it all depends on the whims and fancy of the customs officer.

@Everyone, yes there are many points we can blame the government on, but increasing excise duty for imported mobiles is not the one at the moment. It actually benefits the Indian manufacturers to compete against the cheap Chinese mobiles coming in.

And they've reduced tax on other fronts which would boost the semiconductor industry in India. Overall, the hardware costs should reduce over the course of next few years.

And they've reduced tax on other fronts which would boost the semiconductor industry in India. Overall, the hardware costs should reduce over the course of next few years.

- Status

- Not open for further replies.