No. Hindenburg presented facts which are mostly public.

All Hindenberg has produced is a list of allegations. Not facts.

Put it another way. Is the SC the right body to investigate those allegations of fraud and wrongdoing? that is not what the SC does

But the committee is already biased towards the central government. And will likely delivery sealed judgement. So everyone cheers, and nothing happens.

No, that the SC is involved tells me already that there was no wrongdoing, to begin with, or action to be pursued.

They are a short seller, and there's nothing wrong being short on a company whose fundamentals are broken. I always respect short sellers because it takes extreme due diligence and hard conviction to go against the market leaders - they are the real deal. That level of conviction does not come from political connections.

It's political just on a larger scale. I've already explained where Adani fits into the picture and who wants him to fail. This hit job was two years in the making. They got the timing wrong is what I think. It should have come out earlier to prevent Adani from getting the Haifa port. Still, one could argue it has set him back five years and will prevent him from getting any more in the short term so there is some damage done.

They always have a bias since they are out to make a profit - but as we have seen multiple times, they are essential to corporate governance considering our regulatory agencies are just sitting ducks most of the time (not just India).

Give examples

They always have a bias since they are out to make a profit

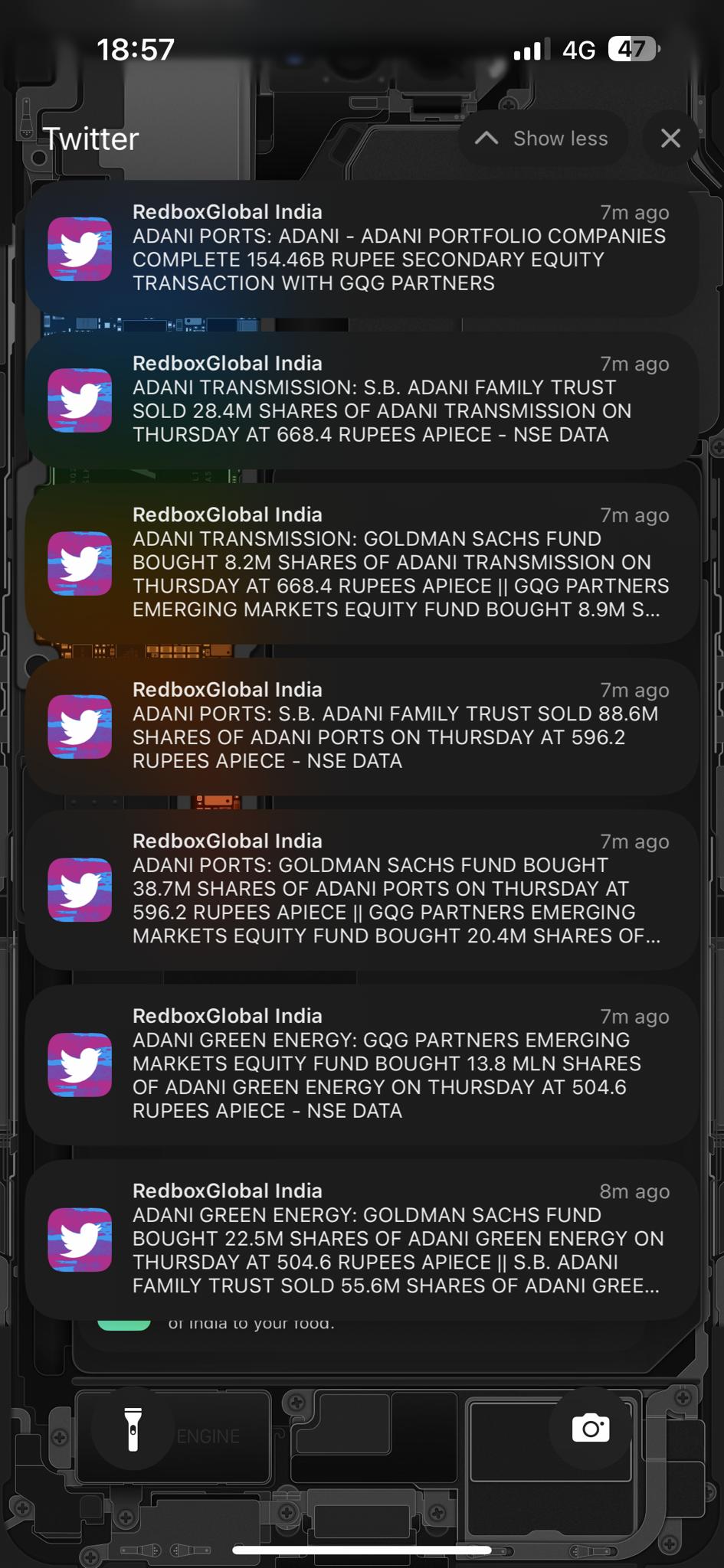

This is the other thing. How much was made by short sellers? any ballpark figure of the total

We are given to understand that $100bn was wiped out.

Now if these short sellers only made a few million that means this was a hit job with the intent to take Adani out. That the bigger payoff was political, not pure profit. That the people who sanctioned it are big enough to protect Hindenberg.

India Inc has many extremely well managed firms - all the way from small caps to large caps. That's the reason why nothing happened to others.

You also know deep down that the Corpfin governance of the Adani group is far from kosher.

Contrary to what you may think, Indians as well as the wider world accord a very large importance to clean corporate governance - as it should be.

I'm not the one saying there isn't clean corporate governance. There has to be or people would not be putting their money in the market. People are making out like this is going to be the next Satyam. There are people alleging that is the case and doing real damage in the process.

No, they trust the external entity because it simply validates what most already knew ..

ANd since you won't agree to this, The proof of the pie is in the eating. The number of retail investors here (or elsewhere) putting money into Adani group stocks (prior to Hindenburg) is but a tiny fraction of those who hold say Tata group stocks.

Why do you think is that?

The answer to your question lies in how much those bonds were worth before this report came out. How did they get these high valuations? Quite a few people thought they were worth that much. Whether these were retail investors to me isn't important. That they attracted the asking price from whatever investor is.

The charge is they were overvalued and this happened due to market manipulation. really?

You could say a lot of things sell for much more than they are worth isn't it

Personally this is the reason why I don’t invest in indian stocks. For me Adani’s strategy of bribing corrupt government to grow is a red flag. This was exactly what happened in soviet era russia resulting in oligarchy. Again… read Magnitsky act.

Yeah, go tell that to your arms companies and big pharma. Those people are so powerful that no president can go against them. Eisenhower pointed that out. Nothing changed much since he said so.

It's the same deal everywhere. I will fund your political campaign in exchange for windfall profits. Democracy does not come for cheap. Neither do elections.

That the odds of an American president getting a second term are a great deal higher than for an Indian PM should tell you what the story in the US is.