chetansha

Juggernaut

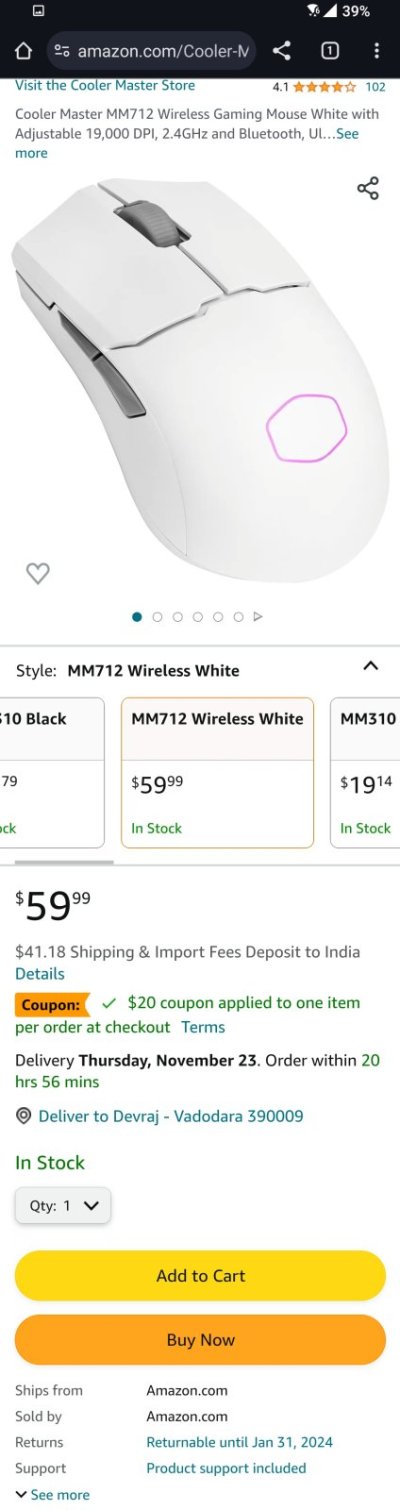

Import duty for hdd is 0%, only igst 18% is To be charged, yet we are forced to pay import duties.Directly from Amazon US (if the seller ships to India), B&H and eBay (again if the seller is ready to ship). Be prepared to pay the duty. I am not aware of any option where you can skip or reduce the duty.

era to a dacoiting 41% or more in lotus era is the problem

era to a dacoiting 41% or more in lotus era is the problem