haha true.That's the whole problem and don't the BJP know it. They can do pretty much anything and no one can or will do anything about it. I feel the AAP was asking some of the right questions, but when an intelligent, good question is asked by a bunch of retards, the question itself loses all value and credibility. Sad indeed.

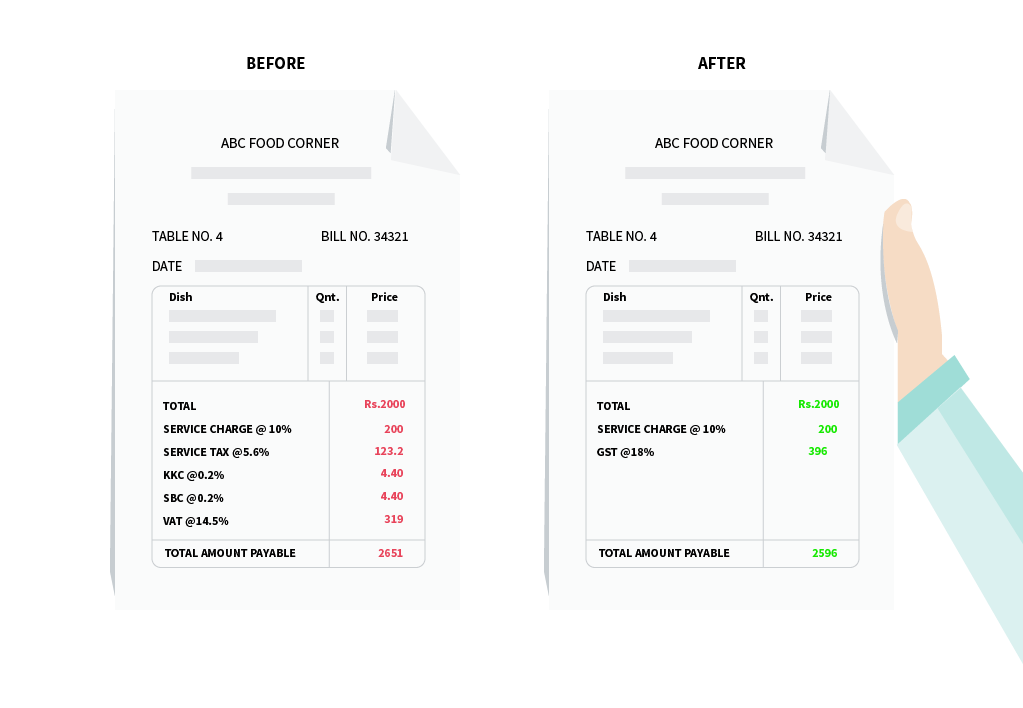

No one is against one single uniform tax. The problem is the cost increased esp. the import costs. So many "hidden costs" here and there in this GST. There is no clarity from the govt., Is this worth to the consumer? Not me.which means computerization of invoices and tax forms. And it's going to be a single tax(called GST) instead of various taxes. It's simplified.

I feel that Modi is doing all these on the pretext of "Make in India." No one is going to make shit here if the taxes are high. India is not U.S. or China.