GST and its impact on YOU!

- Thread starter swatkats

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Mr.J

Innovator

GST Will Benefit Honest Taxpayers

Just like demonetization? That benefited honest citizens who were not hoarding black money. Or at least what this govt. claimed.

Such spin. Much wow.

N

NotMyRealName

All my banks have sent me messages saying ST of 15% will now be GST 18%.

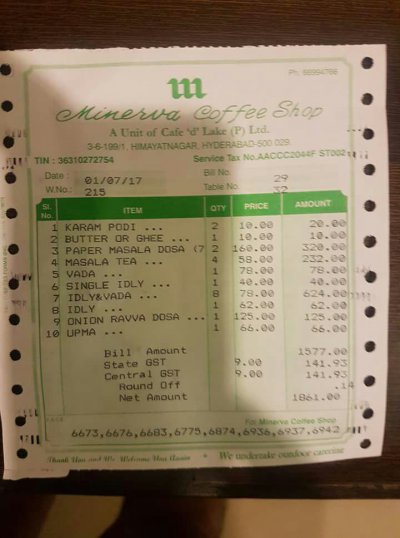

I saw in a restaurant bill from a couple days ago, KKC and SBC are 0.2% each with service tax 5.6%. Have they reduced it from 0.5%? The already convoluted tax system is probably just gonna get more so. But also higher overall, sadly...

I saw in a restaurant bill from a couple days ago, KKC and SBC are 0.2% each with service tax 5.6%. Have they reduced it from 0.5%? The already convoluted tax system is probably just gonna get more so. But also higher overall, sadly...

Mr.J

Innovator

Same here for insurance.All my banks have sent me messages saying ST of 15% will now be GST 18%.

I saw in a restaurant bill from a couple days ago, KKC and SBC are 0.2% each with service tax 5.6%. Have they reduced it from 0.5%? The already convoluted tax system is probably just gonna get more so. But also higher overall, sadly...

I have to pity those who thought any tax reform would be to reduce the tax burden on the people. The original purpose of GST was to simplify the tax system with a single tax at a uniform rate. But the ways its implemented in India with all the slabs and arbitrary categorization and various kinds of exceptions, its become so much more complicated that even the CA's are having a hard time figuring out the regulations. GST also brought tax liability on a whole plethora of new things.

For instance, there used to be service tax on maintenance charges only if the amount per month > Rs 5000 which is not a lot of buildings, now you also need to pay 18% GST if the total collection of a society exceeds 20 Lac. Even with a moderate maintenance charge of Rs 3000, you only need to have 667 flats in the society in order to exceed the 20 lac limit and would be forced to pay GST @ 18% = Rs 540 more per month.

For instance, there used to be service tax on maintenance charges only if the amount per month > Rs 5000 which is not a lot of buildings, now you also need to pay 18% GST if the total collection of a society exceeds 20 Lac. Even with a moderate maintenance charge of Rs 3000, you only need to have 667 flats in the society in order to exceed the 20 lac limit and would be forced to pay GST @ 18% = Rs 540 more per month.

chetansha

Juggernaut

Discs, tapes, solid-state non- volatile storage devices, "smart cards" and other media for the recording of sound or of other phenomena, whether or not recorded, including matrices and masters for the production of discs.^^ I already know about peripherals. Need to know which slab components are put under

Product Code: 8523

18%

http://m.hindustantimes.com/interactives/gst-rate-complete-list/

Just now spoke to my friend in rasi peripheral, all components 18%

Monitor 28%, mobiles 12%.

How much was VAT on these items earlier ?

Last edited:

Any idea, Why there's no GST applicable for Petrol and diesel?

By any slab they'll become much cheaper than pre GST. Rest everything could have been easily accepted by all.

at 2:00

N

NotMyRealName

...The original purpose of GST was to simplify the tax system with a single tax at a uniform rate. But the ways its implemented in India with all the slabs and arbitrary categorization and various kinds of exceptions, its become so much more complicated...

And there are still people who believe the bjp govt. is better than congress. Even with all their scams the congress has probably ripped off the people and the country less than the bjp has in 3 years. People voted a street pickpocket out of power and a mastermind into...[DOUBLEPOST=1498944241][/DOUBLEPOST]

at 2:00

The spin is strong in this one. Almost as good as the supreme leader...

Last edited by a moderator:

And there are still people who believe the bjp govt. is better than congress. Even with all their scams the congress has probably ripped off the people and the country less than the bjp has in 3 years. People voted a street pickpocket out of power and a mastermind into...[DOUBLEPOST=1498944241][/DOUBLEPOST]

The spin is strong in this one. Almost as good as the supreme leader...

LOL. I think you have no idea about scamgress....

chetansha

Juggernaut

This nov budget it will be reduced, and 2018 nov they will remove income tax and introduce bank transaction tax.So they will merge the 12% & 18% slabs to 18% in about 2 years (right around the time of elections)?

LOL. I think you have no idea about scamgress....

Anybody who thinks BJP is any different than congress when it comes to corruption is utterly naive. You only have to look at the people in Modi's cabinet for that. In fact, the current BJP is not just content with filling their own coffers. Modi wants absolute power over the country to the same extent as in North Korea and every move they are doing is towards that end. Be it linking Aadhar to everything and put your entire life, identity and savings at the mercy of the govt or GST where states lose all tax revenue sources and have to rely on the centre for everything or demonetization which is to ensure that people lose access to their own money and black money is made a privilege allowed only for BJP politicians. To be honest, Modi already has so much power and control that the day is not very far off when he announces that democracy is dissolved.

This nov budget it will be reduced, and 2018 nov they will remove income tax and introduce bank transaction tax.

Unlikely that any of the rates would be reduced. I hope you already know that BJP initially pushed for a 28% flat rate on every thing which was opposed and they finally had to reach a compromise with the 4 slab system.

As for bank transaction tax, if they do introduce it, it would be in addition to the income tax. There is no reason for them to remove one when they can force people to pay both. I would also say that interest on savings and deposits would also be removed and replaced with a bank charge.

Requesting people to keep the posts confined to the title thread and not be political. Don't BS us with your Congressi or Modi or AAP bhajana

Since yesterday, I've been to shops and hotels who make turn over in crores. They have no clue what goes from where to where.

Govt has failed miserably to educate retailers or dealers about GST. There are fears of hiring CA which would blasts their bills and these Crook CA for monthly filing are asking huge amounts such as Rs 3000/month minimum.

Last edited by a moderator:

- Status

- Not open for further replies.

Lovin' it!

Lovin' it!